Newsletter

Keep yourself update with our current news for Juwai IQI

Hong Kong Market Shows Office Stability and Residential Momentum

Written by Nelson Li, Head of IQI Hong Kong Office Sector Hong Kong’s Grade A office market posted a strong performance in October, with net absorption reaching 293,300 sq ft—driven by continued consolidation and a flight-to-quality as tenants capitalise on attractive lease terms. Notably, Migao Group Holdings expanded its footprint, leasing over 10,000 sq ft at Cheng Kong Center II in Central. Vacancy rates continued to ease overall, dipping to 13.1%, with notable declines in Wanchai/Causeway Bay (10.5%) and Tsimshatsui (7.5%). Central saw a marginal rise to 11.5% due to tenant relocations within the submarket. Office rents remained broadly stable month-on-month. Central recorded its first rental increase since May 2022, edging up by 0.1%, alongside a similar gain in Tsimshatsui. In a landmark transaction, Alibaba and Ant Group acquired the top 13 floors of One Causeway Bay, including signage rights and parking, for HKD 7.2 billion—Hong Kong’s largest office deal since 2021. Residential Sector The residential market continued to gain traction in October, with total transaction volume up 1.3% month-on-month to 5,714 units—the highest monthly value of the year at HKD 51.1 billion. Mass residential capital values climbed 0.8% month-on-month, following a 0.6% rise in September. Mortgage conditions also improved, as several banks lowered prime rates by 12.5 basis points to 5.0%, easing borrower pressure and supporting broader market recovery. On the primary side, Henderson Land’s “woodis” development in Wanchai sold out its first batch of 75 units, achieving prices between HKD 20,400 and 25,800 per sq ft. In the luxury segment, a villa at Twelve Peaks on The Peak changed hands for HKD 352 million—equivalent to HKD 80,752 per sq ft. Source: The Land Registry, JLLDiscover more here:Download Now!

7 January

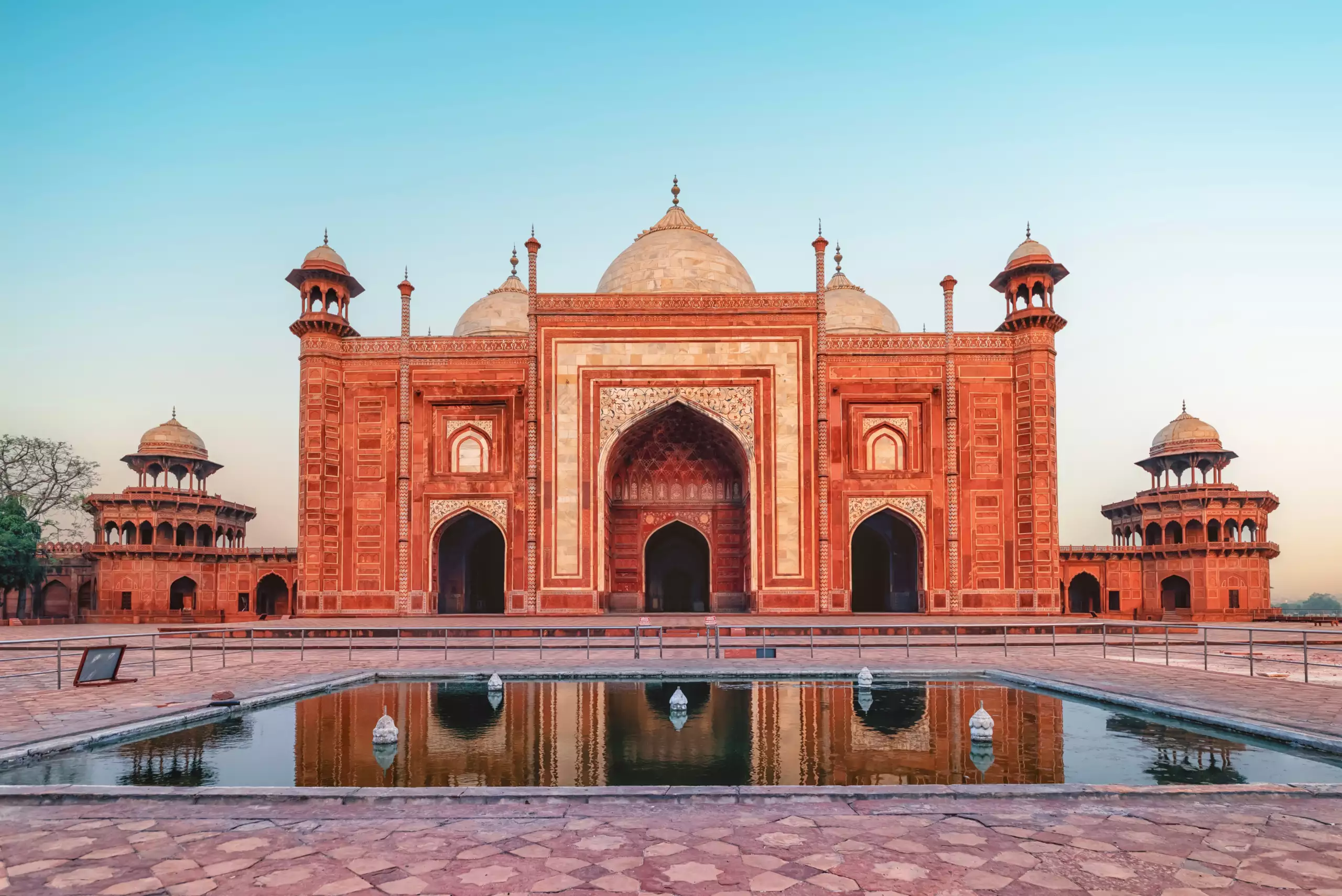

India’s Retail Market Emerges as a Regional Growth Leader

Written by Manu Bhazan, Country Head of India India’s retail sector is entering a period of structural transformation, driven by rising disposable incomes, rapid urbanisation, and growing demand for premium consumer experiences. These forces are positioning India as one of the strongest retail growth markets globally. India’s Tier 1 cities led retail rental growth in the APAC region. Galleria Market recorded a 25 percent year-on-year increase, followed by Connaught Place at 14 percent and Kemps Corner at 10 percent. Across 16 tracked retail locations, average rental growth reached 6 percent, outperforming both global and APAC averages. In contrast, Khan Market saw a more modest 3 percent increase, signalling a shift in retailer preference toward emerging, consumption-led neighbourhood hubs. Galleria Market’s ascent was also reflected globally, climbing to 26th in APAC rankings in 2025, up from 31st last year, with annual rents of $169 per sq ft. Connaught Place ranked alongside it at 26th, supported by strong leasing momentum. High streets remain central to India’s retail landscape, accounting for over 50 percent of year-to-date leasing activity. Supported by sustained GDP growth, urbanisation, and an expanding middle and affluent class, consumer spending on dining, fashion, wellness, and lifestyle categories continues to rise. Combined with limited high-quality retail supply, these dynamics have positioned India’s retail sector as a clear regional outperformer. Discover more here:Download Now!

7 January

Pakistan Real Estate Outlook 2026: Emerging Opportunities

Written by Junaid Hamid, Head of IQI Karachi Pakistan Pakistan’s real estate market is entering a new growth phase heading into 2026, supported by urban expansion, infrastructure development, digital adoption, and policy reforms. These structural shifts are reshaping demand across residential and commercial segments. Rapid urbanisation in Karachi, Lahore, and Islamabad continues to push housing demand higher, particularly in areas linked to new transport and infrastructure projects. Well-connected suburbs are emerging as key value drivers, offering long-term appreciation potential. The affordable and middle-income housing segment is becoming increasingly important as Pakistan’s middle class expands. Compact layouts, gated communities, and flexible payment plans are improving access to homeownership, positioning this segment as a core growth engine through 2026. Sustainability and smart living features are also gaining traction. Energy-efficient designs, smart security systems, and modern urban planning are increasingly expected across both mid-tier and premium developments, supporting long-term asset value. Technology is transforming how properties are marketed and sold. Online listings, virtual tours, and property platforms are improving transparency and attracting tech-savvy buyers and overseas Pakistanis, while giving digitally enabled developers a competitive edge. Beyond residential, commercial and mixed-use developments are gaining momentum. Demand for co-working spaces, retail centres, and integrated projects is rising alongside startup growth and an expanding urban workforce. By 2026, Pakistan’s real estate sector is expected to be more structured, technology-driven, and inclusive. Investors and buyers focused on infrastructure-led locations, middle-income housing, and credible developers are best positioned to benefit from the market’s next growth phase. Discover more here:Download Now!

7 January

Vietnam’s Market Shows Diverging Trends Between HCMC and Hanoi

HCMC Apartment Prices Triple Over the Past Decade Apartment prices in downtown Ho Chi Minh City have nearly tripled over the past ten years, driven by sustained demand and limited new supply, according to a report by property listing platform Batdongsan. The average price rose from VND31 million (US$1,175) per square metre in 2015 to VND92 million this year. This appreciation trails only land prices, which surged 4.8 times over the same period. In the third quarter, the average price in District 1—the city’s most expensive area—reached VND413 million per square metre. Newly launched units are priced between VND200 million and VND500 million, with annual growth of 10–30%. Hanoi Apartment Market Cools, Flippers Struggle Meanwhile, Hanoi’s apartment market is facing a slowdown. Speculators are finding it difficult to sell units even after lowering prices, as buyers hold out for more affordable options amid an increase in new supply. This contrasts sharply with just three months ago, when newly launched apartments were quickly snapped up by eager buyers. Discover more here:Download Now!

6 January

Canada’s Housing Market Shows Early Signs of Stabilisation as Sales Recover and Prices Steady

Written by Yousaf Iqbal, Head of IQI Canada In November 2025, Canada’s housing market showed early signs of renewed momentum as national home sales rose and prices began to stabilise. The national average home sale price reached about C$690,195, up modestly month-over-month and down only around 1.1% compared with last year — narrowing the year-over-year drop. With sales climbing and listings somewhat pressured, the supply-to-demand balance remained within historically “normal” bounds. Interest rates set by the Bank of Canada at 2.25% have kept borrowing costs moderate, creating a modest boost to affordability — though many markets remain expensive for first-time buyers. Toronto (GTA) In November 2025, GTA home sales dropped 15.8% year-over-year to 5,010 transactions, with new listings down 4% to 11,134, as many buyers stayed cautious amid economic uncertainty. Prices continued to ease: the MLS® HPI Composite fell 5.8% annually, and the average selling price declined 6.4% to $1,039,458. On a seasonally adjusted basis, both sales and listings edged slightly lower from October, while prices held mostly steady. With borrowing costs lower and improving job data, confidence is expected to gradually build heading into 2026. VancouverIn November 2025, Metro Vancouver home sales dropped 15.4% year-over-year to 1,846, while active listings climbed 14.4% to 15,149, keeping conditions firmly in buyers’ territory. New listings edged down 1.4% to 3,674, though overall inventory remained well above long-term averages. The MLS® HPI benchmark fell 3.9% annually to $1,123,700, with detached, attached, and apartment prices all softening slightly from last year. Ample supply, slower sales, and steady borrowing costs continued to shape a quiet, buyer-friendly market heading into year-end. Quebec (province-wide) In November 2025, home sales remained stable at around 16,000 transactions, with activity holding near last year’s levels despite regional differences.Inventory increased modestly, driven mainly by rising listings in major centres like Montréal. Median prices continued to trend upward province-wide: single-family homes rose to roughly C$635,000, condos held near C$425,000, and plex prices climbed to about C$855,000, supported by strong demand for multi-unit properties. Overall, the market stayed balanced, with supply improving and prices remaining resilient heading into year-end. Discover more here:Download Now!

6 January

Juwai IQI’s CEO Provides a Malaysia Forecast for 2026

Written by Dave Platter, Global PR DirectorMalaysia’s residential property market is entering 2026 with a rare combination of rising prices, tightening supply and improving buyer confidence, a contrast to conditions in many global markets. According to Juwai IQI Co-Founder and Group CEO Kashif Ansari, 2025 was largely a year of absorption, as long-delayed projects finally reached completion.Developers delivered 23.4% more new homes than in 2024, yet the market absorbed the additional supply smoothly.Even the long-standing serviced apartment overhang declined by 11% year-on-year, signalling healthier underlying demand. Looking ahead, new supply is easing. Construction starts have fallen 2%, while pre-construction pipelines are down nearly 18%, pointing to fewer launches in the years ahead.This tightening is occurring just as demand fundamentals strengthen. Nearly half of Malaysia’s population is under 30 or aged between 30 and 44, prime life stages for household formation and home upgrading. Price performance has also been resilient. Malaysia has not recorded an annual price decline since at least 2021, underscoring the market’s stability. Johor Emerges as a Regional Standout If 2025 was about clearing excess supply, 2026 is shaping up to be a more competitive market.With fewer new projects in the pipeline, buyers targeting well-located homes along key infrastructure corridors may face tighter conditions and potential bidding pressure. Johor stands out as a regional outperformer. Home purchases in the state rose 13% in the first half of the year, while prices increased 5.7% year-on-year. Cross-border demand from Singapore continues to strengthen, including interest from Malaysians currently living there. The upcoming RTS link is expected to further transform the market, and Juwai IQI estimates the new Special Economic Zone could add RM19.8 billion to Malaysia’s GDP over the next decade. Price Growth Expected in 2026 Mr. Ansari forecastsnational price growth of 2–4% in 2026, supported by constrained supply, steady demand, and improving household incomes. The primary downside risk would be an external shock severe enough to impact global employment and consumer confidence. Absent such a disruption, 2026 is on track to be Malaysia’s strongest year for residential real estate since 2019. Discover more here:Download Now!

5 January

Where to Invest in 2026: Interest Rates, Sustainability and Emerging Cities

Written by Taco Heidinga, IQI Global Strategic Advisor As 2025 draws to a close, property investors are looking ahead to 2026 with cautious optimism. Shifting interest rate cycles, evolving demand patterns and structural supply constraints are shaping where capital is likely to flow next. Interest Rates, Affordability & Buyer Activity Several major economies, including the UK, are expected to see continued interest rate cuts into 2026. This should improve mortgage affordability and support a recovery in buyer activity, particularly among first-time buyers and home upgraders. Historically, lower borrowing costs have translated into higher transaction volumes and steadier price growth. Shift Toward Secondary & Emerging Cities Investor focus is increasingly moving beyond prime capital cities toward secondary and emerging urban centres. More affordable pricing, infrastructure upgrades and improved liveability are driving demand in commuter towns, satellite cities and lifestyle markets. Remote and hybrid work continues to reshape housing demand beyond traditional city cores. Sustainability & Smart Buildings Energy-efficient and green-certified buildings are gaining premium value. Buyers and tenants are prioritising lower operating costs, while governments are tightening environmental standards. Sustainability is rapidly shifting from a value-add to a baseline requirement for long-term asset performance. Inflation Hedge & Supply Constraints Real estate remains widely viewed as a hedge against inflation. At the same time, high construction costs and tighter credit conditions are restricting new supply in many markets, supporting price stability where demand remains resilient. Discover more here:Download Now!

5 January

1.3 Million Civil Servants: The ‘Sleeping Giant’ That Could Shake Up the 2026 Property Market

Written by Muhazrol Muhamad, GVP, Head of Bumiputra Segment While market discussions often focus on foreign buyers or the gig economy, data points to a far larger and more stable demand base: Malaysia’s 1.3 million civil servants. From December 2024, civil servants received a salary increase of over 13 percent, the largest in public service history. This has significantly boosted purchasing power and housing loan eligibility. Despite this, only about 774,000 civil servants currently have active loans under the Public Sector Home Financing Board (LPPSA), leaving more than 500,000 potential buyers still inactive. If just 10 percent of this group enters the market in 2026 with an average purchase of RM350,000, it would inject over RM17 billion into the property market, enough to meaningfully reduce residential overhang in key states. The salary hike also expands financing capacity. An officer previously earning RM3,500 could typically qualify for around RM380,000 in financing. After the increase, income of roughly RM4,000 raises eligibility to over RM430,000, shifting buyers from apartments into landed terraced homes, which remain the preferred segment. For existing homeowners, the Second LPPSA Financing offers a further advantage. Civil servants enjoy a fixed 4.0 percent interest rate for both first and second loans, providing stability at a time when private-sector borrowers face floating rates. Heading into 2026, civil servants are positioned to be one of the most important drivers of housing demand, supported by higher incomes, fixed-rate financing, and a large pool of buyers yet to enter the market. Discover more here:Download Now!

5 January